Case Study: Competitive Market Intelligence for Hospitals with soviews+

A Texas-based health system facing competition in multiple metro areas sought to synthesize market data and creative samples from other top hospitals. The solution? soviews+, a custom portal featuring detailed, market-specific intelligence and creative samples from multiple DMAs in one comprehensive dashboard. Read our latest case study to learn how we leveraged soviews+ to illuminate market opportunities and capture share of voice for this health system.

Learn more about soviews+, the only interactive competitive media market profile designed exclusively for hospitals:…

Read more

There has been a notable uptick in consumer use of products, services and web/mobile applications that cater to their increasing desire to maintain an overall healthy state of being. The connected wearable device category alone reached 453 million users in 2017, and it is projected to nearly double by 2021 (findings available

There has been a notable uptick in consumer use of products, services and web/mobile applications that cater to their increasing desire to maintain an overall healthy state of being. The connected wearable device category alone reached 453 million users in 2017, and it is projected to nearly double by 2021 (findings available  …

… In our first #lifecare series

In our first #lifecare series

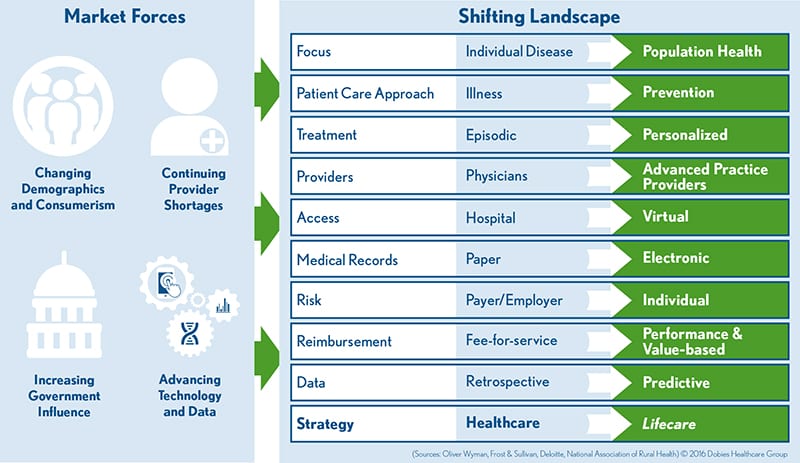

No other industry has seen quite the magnitude of change as healthcare. Today, nearly every facet of the industry is radically transforming as our core business focus shifts from illness to prevention. Providers and vendors are forced to transform their practices as they secure a meaningful role in the industry.

No other industry has seen quite the magnitude of change as healthcare. Today, nearly every facet of the industry is radically transforming as our core business focus shifts from illness to prevention. Providers and vendors are forced to transform their practices as they secure a meaningful role in the industry. After attending a Kansas City Healthcare Communicators Society (KCHCS) educational session, I began to think more about the role of marketers in hospital price transparency initiatives. Participants at the session joined in a lively discussion about consumer expectations for comparative data on healthcare costs. With many

After attending a Kansas City Healthcare Communicators Society (KCHCS) educational session, I began to think more about the role of marketers in hospital price transparency initiatives. Participants at the session joined in a lively discussion about consumer expectations for comparative data on healthcare costs. With many